What gives money its value?

Money originally took the form of a commodity such as gold or silver (or grain, in the earliest cases), and as such it had a recognized market value. After the introduction of bank notes and coins that lacked intrinsic value (ie, weren’t worth their weight in gold), money became representative of a value rather than actually holding that value itself. This ‘representative money’ acted like a certificate to show that a certain amount of gold or silver was stored at the central bank, or treasury, in the way that a note for one pound sterling could be exchanged for one troy pound of sterling silver. In effect it was a promise by the government, or the bank on the government’s behalf, to hand over that amount of bullion.By the 19th century, most of the world’s currencies had become ‘representative’ by being linked to the gold standard, and remained so until the 1970s, after which time money became nothing more than a government promise.

There’s no particular reason why the value of money should be linked to gold, but there is a very good reason why the quantity of money in circulation should be determined by genuine economic activity; the real wealth of industry. If money doesn’t represent real wealth, what gives it value? What is there to back up that government promise? Nothing.

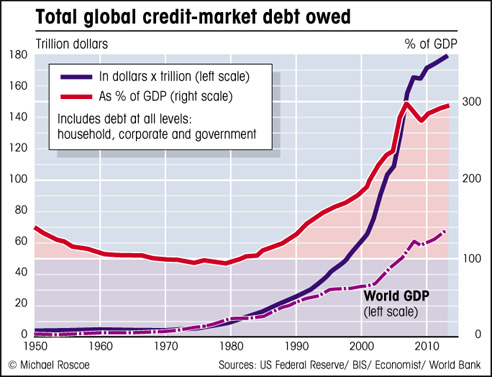

And this is the situation that we find ourselves in now – I demonstrate in my book how around one third of all money in circulation globally is not backed up by real industrial wealth. In other words, at least one third of government guarantees are worthless because they are based on debt rather than genuine wealth.